The 6-Minute Rule for Mortgage Brokerage

Wiki Article

The smart Trick of Mortgage Broker That Nobody is Discussing

Table of ContentsAbout Mortgage Broker AssociationThe Definitive Guide to Mortgage Broker Average SalaryThe Definitive Guide to Mortgage Broker MeaningMortgage Broker Assistant Job Description - TruthsNot known Factual Statements About Mortgage Broker Association The Best Strategy To Use For Broker Mortgage Rates

"What do I do currently?" you ask. This very first meeting is basically an 'info gathering' objective. The mortgage broker's job is to recognize what you're attempting to attain, exercise whether you prepare to leap in every now and then match a loan provider to that. Prior to talking concerning loan providers, they require to gather all the details from you that a financial institution will need.

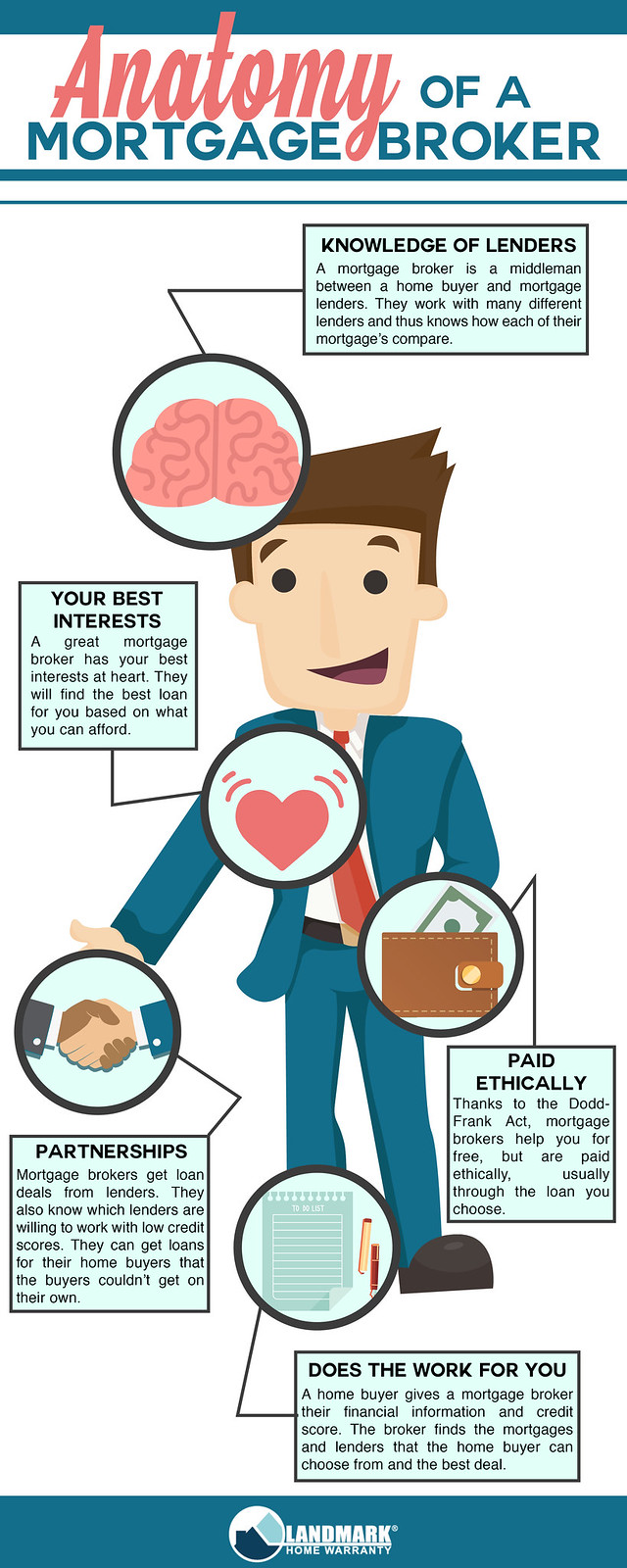

A significant adjustment to the industry happening this year is that Home mortgage Brokers will certainly have to adhere to "Ideal Passions Responsibility" which indicates that lawfully they have to place the client. Surprisingly, the financial institutions do not have to abide by this new guideline which will profit those clients using a Mortgage Broker even extra.

The Main Principles Of Mortgage Broker Vs Loan Officer

It's a home mortgage broker's work to help get you ready. Maybe that your financial savings aren't quite yet where they should be, or maybe that your earnings is a bit doubtful or you've been independent and the banks need more time to analyze your scenario. If you're not yet prepared, a home mortgage broker is there to outfit you with the expertise and guidance on just how to improve your placement for a loan.

Your house is your own. Written in collaboration with Madeleine Mc, Donald - mortgage broker job description.

Unknown Facts About Mortgage Broker Salary

They do this by contrasting home mortgage products offered by a range of lenders. A home loan broker functions as the quarterback for your financing, passing the sphere between you, the borrower, as well as the loan provider. To be clear, mortgage brokers do much more than assist you obtain a straightforward home loan on your house.When you go to the financial institution, the financial institution can just use you the services and products it has readily available. A bank isn't likely to inform you to go down the road to its competitor that provides a home loan product much better suited to your requirements. Unlike a financial institution, a home loan broker typically has connections with (usually some loan providers that don't directly handle the general public), making his chances that far better of discovering a lender with the very best home mortgage for you.

If you're wanting to refinance, gain access to equity, or acquire a bank loan, they will certainly need details regarding your current fundings already in area. When your mortgage broker has a good concept regarding what you're trying to find, he can sharpen in on the. In most cases, your mortgage broker may have almost whatever he requires to proceed with a home mortgage application at this moment.

Little Known Questions About Broker Mortgage Meaning.

If you have actually currently made a deal on a residential property and it's been accepted, your broker will certainly submit your application as an online deal. Once the broker has a mortgage commitment back from the lender, he'll review any problems that require to be met (an appraisal, evidence of earnings, evidence of down payment, and so on).As soon as all the lending institution problems have been satisfied, your broker must ensure lawful instructions are sent to your attorney. Your broker should continue to sign in on you throughout the process to make sure every little thing goes smoothly. This, in short, is exactly how a home mortgage application works. Why make use of a home loan broker You may be wondering why you should utilize a home mortgage broker.

Your broker should be well-versed in the home mortgage items of all these lending institutions. This click to find out more implies you're a lot more likely to find the finest mortgage item that suits your needs - mortgage broker assistant.

An Unbiased View of Mortgage Broker Average Salary

When you shop on your own for a home loan, you'll need to make an application for a home mortgage at each loan provider. A broker, on the other hand, need to know the lenders like the rear of their hand as well as must be able to hone in on the lending institution that's finest for you, saving you time as well as safeguarding your credit history from being decreased by applying at way too many lending institutions.Make certain to ask your broker the number of lenders he handles, as some brokers have access to more lending institutions than others and also might do a greater quantity of organization than others, which indicates you'll likely obtain a far better rate. This was a review of dealing with a mortgage broker.

85%Advertised Price (p. a.)2. 21%Comparison Rate (p. a.) Base standards of: a $400,000 financing quantity, variable, dealt with, principal as well as interest (P&I) mortgage with an LVR (loan-to-value) ratio of More hints at the very least 80%. Nevertheless, the 'Contrast Residence Loans' table allows for estimations to made on variables as selected and also input by the customer.

Broker Mortgage Near Me Can Be Fun For Anyone

The alternative to using a home mortgage broker is for individuals to do it themselves, which is sometimes referred to as going 'direct'. A 2018 ASIC survey additional hints of customers that had actually obtained a lending in the previous 12 months reported that 56% went straight with a lender while 44% went through a mortgage broker.Report this wiki page